With the Dec. 1, 2016, deadline for the Department of Labor (DOL) Final Overtime Rule approaching, employers across the country are urgently working to implement new compensation and classification practices. But recently, the DOL has been facing much criticism and resistance, as evidenced by a duo of federal lawsuits filed last week and a House vote to delay the rule’s implementation.

With the Dec. 1, 2016, deadline for the Department of Labor (DOL) Final Overtime Rule approaching, employers across the country are urgently working to implement new compensation and classification practices. But recently, the DOL has been facing much criticism and resistance, as evidenced by a duo of federal lawsuits filed last week and a House vote to delay the rule’s implementation.

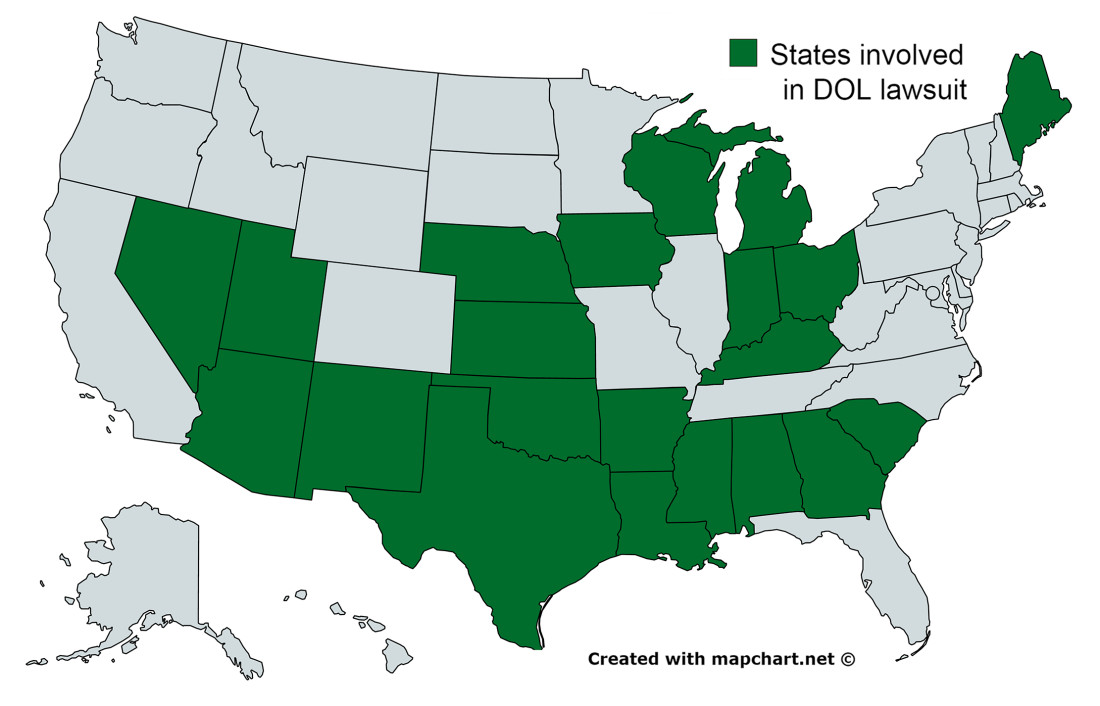

The first suit was filed by a coalition of 21 states, and the second by a coalition of business groups led by the U.S. Chamber of Commerce. Both sets of plaintiffs argue that the DOL was “arbitrary and capricious” in adopting the new threshold — i.e., that the department ignored evidence in the record and failed to sufficiently explain the basis for its new rule, which more than doubles the salary-level threshold for employees to be exempt from overtime.

Further resistance came Sept. 28, when the House Rules Committee debated proposed legislation, introduced by Rep. Tim Walberg (R-Mich.), that would delay implementation of the final rule. The legislation, known as The Regulatory Relief for Small Businesses, Schools and Nonprofits Act, would delay the rule until June 2017, if the Senate were to also pass it and if it were signed by the president.

Walberg argued before the committee, stating, “We all agree our nation’s overtime rules need to be updated and modernized …. the administration should withdraw the rule completely and update our laws responsibly. Unfortunately, the clock is ticking. A six-month delay provides much needed relief.”

Rep. Rob Woodall (R-Ga.) also spoke regarding his support for the bill, noting that while the rule was necessary to update a standard that had not been addressed for more than a decade, it was implemented too quickly and without enough time for employers to react. Woodall argued, “To double [the salary threshold] overnight with virtually no warning to the small business community, the nonprofit community, the education community, is not the right way to govern.”

Despite numerous Democratic objections and the potential threat of a presidential veto, the House agreed. With a vote of 246 to 177, the House determined a delay was necessary and that the final rule’s effective date should be pushed back an additional six months.

We are closely tracking any updates to the status of the DOL’s final rule and will keep blog readers informed once the proposed legislation reaches the Senate for debate. If you have questions in the meantime, please contact any of the attorneys in our Employment & Labor Group.

Twenty-one states have filed suit against the federal government seeking a preliminary and permanent injunction to block the Department of Labor’s new overtime rule and declare it unlawful.

Twenty-one states have filed suit against the federal government seeking a preliminary and permanent injunction to block the Department of Labor’s new overtime rule and declare it unlawful. The enforcement of anti-retaliation provisions in new injury and illness reporting regulations for employers has been delayed until Nov. 1, 2016.

The enforcement of anti-retaliation provisions in new injury and illness reporting regulations for employers has been delayed until Nov. 1, 2016. On July 28, 2016, the U.S. Court of Appeals for the Seventh Circuit ruled in a precedential decision that existing civil rights laws do not protect against sexual orientation discrimination. Although it was a unanimous decision, the court expressed great displeasure and conflict with the “illogical” legal structure in which “a person can be married on Saturday and then fired on Monday for just that act.”

On July 28, 2016, the U.S. Court of Appeals for the Seventh Circuit ruled in a precedential decision that existing civil rights laws do not protect against sexual orientation discrimination. Although it was a unanimous decision, the court expressed great displeasure and conflict with the “illogical” legal structure in which “a person can be married on Saturday and then fired on Monday for just that act.” Following new rules issued on employer wellness programs, the Equal Employment Opportunity Commission on June 16 released an example of how employers should communicate with their employees about the medical information those programs obtain.

Following new rules issued on employer wellness programs, the Equal Employment Opportunity Commission on June 16 released an example of how employers should communicate with their employees about the medical information those programs obtain. On May 11, 2016, the Occupational Safety and Health Administration (OSHA) published the much-anticipated final rule revising its regulations on the recording and reporting of occupational injuries and illnesses.

On May 11, 2016, the Occupational Safety and Health Administration (OSHA) published the much-anticipated final rule revising its regulations on the recording and reporting of occupational injuries and illnesses. On May 26, 2016, the U.S. Court of Appeals for the Seventh Circuit issued its decision in

On May 26, 2016, the U.S. Court of Appeals for the Seventh Circuit issued its decision in  On May 18, 2016, the U.S. Department of Labor (DOL) released the final rule updating the regulations defining and limiting “white collar” overtime exemptions under the Fair Labor Standards Act (FLSA). These rules apply to workers who fall under the executive, administrative, or professional exemptions from the FLSA’s minimum wage and overtime protections. The rule will go into effect December 1, 2016, giving employers over six months to adjust.

On May 18, 2016, the U.S. Department of Labor (DOL) released the final rule updating the regulations defining and limiting “white collar” overtime exemptions under the Fair Labor Standards Act (FLSA). These rules apply to workers who fall under the executive, administrative, or professional exemptions from the FLSA’s minimum wage and overtime protections. The rule will go into effect December 1, 2016, giving employers over six months to adjust.

On May 16, 2016 the EEOC issued final rules amending the regulations and interpretive guidance implementing Title I of the Americans with Disabilities Act (ADA) and Title II of the Genetic Information Nondiscrimination Act (GINA) with respect to employer wellness programs. These changes clarify that employers may use incentives to encourage participation in wellness programs that include disability-related inquiries and/or medical examinations as long as the programs are voluntary and the incentives do not exceed certain limits. Additionally, the rules confirm that employers may provide incentives when employees’ spouses—but not children—provide certain health information.

On May 16, 2016 the EEOC issued final rules amending the regulations and interpretive guidance implementing Title I of the Americans with Disabilities Act (ADA) and Title II of the Genetic Information Nondiscrimination Act (GINA) with respect to employer wellness programs. These changes clarify that employers may use incentives to encourage participation in wellness programs that include disability-related inquiries and/or medical examinations as long as the programs are voluntary and the incentives do not exceed certain limits. Additionally, the rules confirm that employers may provide incentives when employees’ spouses—but not children—provide certain health information.