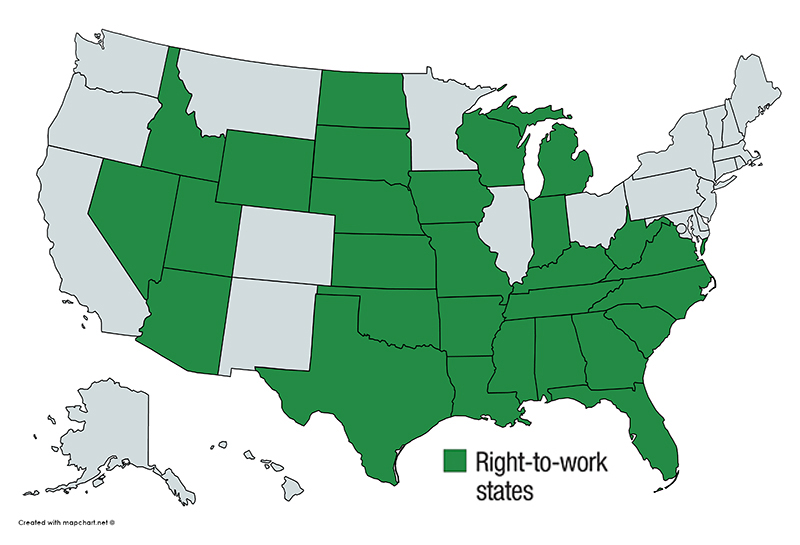

Missouri has become the 28th state to enact right-to-work legislation banning mandatory union dues. Gov. Eric Greitens signed the bill into law on Feb. 6, 2017, and it will take effect on Aug. 28, 2017.

Missouri has become the 28th state to enact right-to-work legislation banning mandatory union dues. Gov. Eric Greitens signed the bill into law on Feb. 6, 2017, and it will take effect on Aug. 28, 2017.

What does this mean for unionized employers? The law’s grandfather clause offers protection for existing labor contracts negotiated prior to the date the law takes effect. Collective bargaining agreements negotiated after the effective date will no longer be able to condition employment on union membership or payment of union dues. Under the law, violations could result in a misdemeanor or liability for monetary damages to workers and the agreement will be deemed void.

Supporters of right-to-work assert that it will bring more jobs to Missouri. Opponents anticipate that the law will do more harm than good.

National Right-to-Work Act

National legislation titled the National Right-to-Work Act was introduced into the U.S. House of Representatives on Feb. 1, 2017. The bill would amend the National Labor Relations Act to remove language permitting union security clauses whereby employers are permitted to require that workers pay union dues as a condition of employment. Commentators have opined that although there have been attempts at similar legislation in the past, the chance of success is now more real given the Republican majorities in both houses of Congress. Furthermore, while on the campaign trail, President Donald Trump endorsed the right-to-work trend.

Organized labor could take a major hit with the passage of a national right-to-work bill. Millions of workers could potentially opt out of union membership. This would mean less dues money for unions, and likely in turn, less power.

We are monitoring the status of the Missouri and national legislation and will cover new developments as they arise. If you have questions about right-to-work laws and what they could mean for you or your business, please contact any of the attorneys in our Employment & Labor Group.

Last week, 60 business groups and four states joined the fight against the Department of Labor’s new overtime rule by filing amicus briefs in the Fifth Circuit asking the court to uphold the district court’s

Last week, 60 business groups and four states joined the fight against the Department of Labor’s new overtime rule by filing amicus briefs in the Fifth Circuit asking the court to uphold the district court’s  The Missouri and Illinois legislatures were quite active in 2016 in creating laws affecting employers, and they have been just as busy in the first few weeks of 2017. Below is a summary of employment law developments that may affect your business in those states in the coming year.

The Missouri and Illinois legislatures were quite active in 2016 in creating laws affecting employers, and they have been just as busy in the first few weeks of 2017. Below is a summary of employment law developments that may affect your business in those states in the coming year.  2016 was a busy year for employment law developments on a national level, and 2017 promises to follow suit. To help employers navigate the changes, here is a summary of major developments that may affect your business this year.

2016 was a busy year for employment law developments on a national level, and 2017 promises to follow suit. To help employers navigate the changes, here is a summary of major developments that may affect your business this year. The U.S. Supreme Court on Jan. 17 ended a yearlong legal challenge to the enforceability of a forum selection clause in an ERISA-governed benefit plan, when the court denied the plaintiff’s petition for writ of certiorari. The case is

The U.S. Supreme Court on Jan. 17 ended a yearlong legal challenge to the enforceability of a forum selection clause in an ERISA-governed benefit plan, when the court denied the plaintiff’s petition for writ of certiorari. The case is  Employers should be on notice that the Department of Homeland Security has published a new edition of the Form I-9 for use beginning no later than Jan. 22, 2017.

Employers should be on notice that the Department of Homeland Security has published a new edition of the Form I-9 for use beginning no later than Jan. 22, 2017. The uncertainty brewing over whether the U.S. Department of Labor’s new overtime rule would actually go into effect on Dec. 1, 2016, came to a halt on the afternoon of Nov. 22 when a Texas federal judge entered a nationwide injunction blocking the DOL from implementing its rule expanding overtime protections.

The uncertainty brewing over whether the U.S. Department of Labor’s new overtime rule would actually go into effect on Dec. 1, 2016, came to a halt on the afternoon of Nov. 22 when a Texas federal judge entered a nationwide injunction blocking the DOL from implementing its rule expanding overtime protections.  A federal judge’s decision to block the U.S. Department of Labor (DOL) from enforcing its new persuader rule means employers may continue hiring legal counsel on unionization issues without facing an argument from the DOL that fees paid to legal counsel must be publicly disclosed.

A federal judge’s decision to block the U.S. Department of Labor (DOL) from enforcing its new persuader rule means employers may continue hiring legal counsel on unionization issues without facing an argument from the DOL that fees paid to legal counsel must be publicly disclosed. As employers are all aware, the U.S. Department of Labor (DOL)’s new overtime rules are set to take effect Dec. 1, 2016. The rule, projected to cover some 4.2 million workers, will raise the minimum salary threshold for overtime exemption 101 percent from its current rate of $455 per week to $913 per week.

As employers are all aware, the U.S. Department of Labor (DOL)’s new overtime rules are set to take effect Dec. 1, 2016. The rule, projected to cover some 4.2 million workers, will raise the minimum salary threshold for overtime exemption 101 percent from its current rate of $455 per week to $913 per week. Election Day, Nov. 8, is almost here, and employers should be ready for the questions employees may have about taking time off to vote. Additionally, employers should make sure any company policies comply with state laws concerning time off for voting.

Election Day, Nov. 8, is almost here, and employers should be ready for the questions employees may have about taking time off to vote. Additionally, employers should make sure any company policies comply with state laws concerning time off for voting.